The Awesome Power of Compound Interest

The Awesome Power of Compound Interest

June 1, 2020

Summary:

- Compound interest is interest earned on interest

- Compound interest may play an important role in meeting long term goals

- Time is an important component when thinking about compound interest

- The rule of 72 is a shortcut in calculating how long it takes for an investment to double in size

It is often reported that Einstein may have referred to compound interest as “the most powerful force in the universe” and “the eighth wonder of the world.” And who can argue with him? Compound interest is interest earned on interest, or in other words adding interest to principal and earning a return on the new sum. Contrast this to simple interest, in which interest is only earned on the principal amount. When harnessed properly, compound interest can play an important role in meeting our long-term goals and can provide exponential growth on an investment.

There are a few important factors that come in to play when calculating compound interest. These factors include the expected rate of return, the initial investment and any additional investments that will be made. Another important component is how frequently the investment will compound (for example: monthly, quarterly or annually), which is known as compounding frequency. Perhaps the most important factor when thinking about compound interest is time. Time is what allows the value of an investment to snowball, particularly over longer periods. As an investor, the more time you’ve got the better!

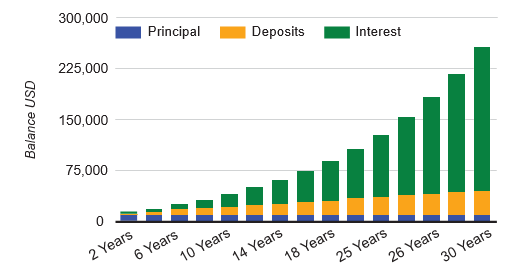

Let’s envision that you start with an initial investment of $10k in an investment that tracks the performance of the S&P 500 index and all dividends are reinvested over a period of 30 years. Compounding occurs annually and the investment earns an annualized rate of return of 8%, which is roughly in line with the long-term historical average. At the end of this period, you would have a sum of over $100k! Now imagine that you decide to add $100 per month to your investment. After 30 years you would end up with a whopping $258k!

The Awesome Power of Compound Interest: $10k invested over 30 years with monthly additions of $100

The rule of 72 is a compound interest shortcut that allows us to determine roughly how long it will take for an investment to double in size. For example, using the 8% return from example above, it would take roughly 9 years for the investment to double in value (72 ÷ 8). If a more conservative portfolio is desired and a rate of return of 6% is expected, it would take about 12 years (72 ÷ 6). This shortcut can help us think about the required rate of return for specific goals such as retirement, and how certain investment strategies and their expected rates of return could fit into achieving those goals.

“He who understands [compound interest], earns it; he who doesn’t pays it,” is another quote popularly attributed to Einstein. Perhaps with a better understanding of compound interest, we can properly understand its power and harness this awesome force towards meeting our long-term goals!

As always, please reach out to your trusted advisor with any questions.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through WCG Wealth Advisors, a registered investment advisor. WCG Wealth Advisors and The Wealth Consulting Group are separate entities from LPL Financial.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All illustrations are hypothetical and are not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing. The S&P 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Investing involves risk including loss of principal. No strategy assures success or protects against loss.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through WCG Wealth Advisors, a registered investment advisor. WCG Wealth Advisors and The Wealth Consulting Group are separate entities from LPL Financial.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market. Government bonds and Treasury bills are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. Investing involves risk including loss of principle.