The Advisor Resource Center (ARC)

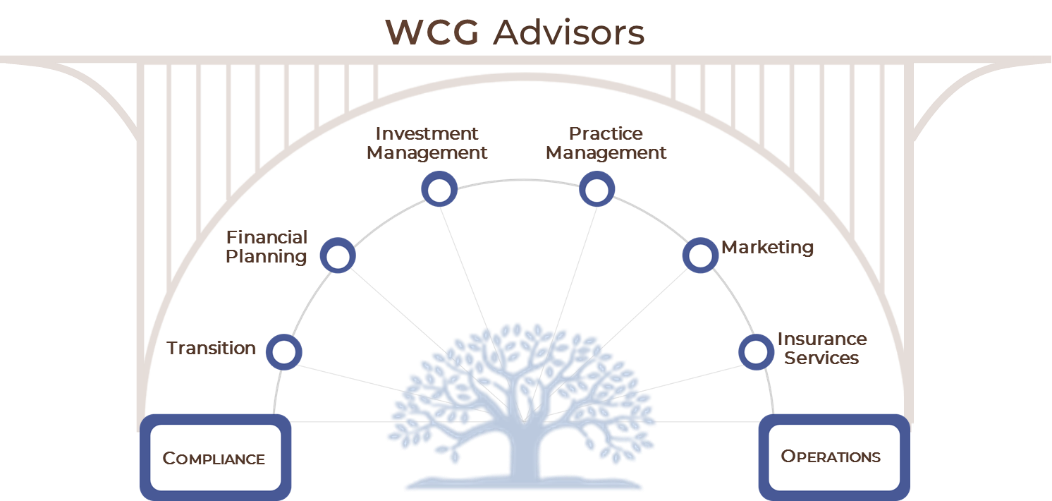

The Advisor Resource Center (ARC) serves as the foundation for your practice and bridges the gap in your journey to enhance or provide Personal CFO level service while freeing you up to spend more time building your business and servicing your clients. We use the ARC acronym and shape to symbolize the support that The Wealth Consulting Group (WCG) provides to advisors.

An “Arc” is a structurally sound shape commonly used in the design of bridges and other structures. The ARC of WCG includes these foundational elements:

Financial Planning

The Financial Planning Team is made up of experienced CFPs and financial professionals available to support WCG advisors through the financial planning process, technology solutions, and other advanced tools to help increase their billable hours and profitability.

Support Highlights

- Fully outsourced financial planning support using eMoney

- By “Fully” we mean ship us the shoebox, and we’ll take it from there partnering with you to create a financial plan complete with recommendations.

- Establish eMoney personal client portal

- An outstanding tool for your clients to utilize. We take the time to work with them to set it up so you don’t have too

- Advanced Resources and Diagnostic Tools

- We have technology and partner resources to meet your advanced planning and analysis needs.

- WCG Technology Bundle

- Our Tech Bundle is full of the latest tools our industry has to offer and is available through association and discounted pricing.

Investment Management

The Wealth Consulting Group’s Investment Strategy Committee (ISC) manages the firm's model portfolios that are offered via WCG Wealth Advisors, LLC (dba The Wealth Consulting Group) a SEC registered investment advisor. The committee is comprised of members who have extensive industry experience. The ISC believes in managing portfolios using a core plus satellite strategy that incorporates both active and passive investment strategies. The core is managed using strategic asset allocation adding satellite positions to provide alpha to our portfolios. Our goal is to provide competitive returns for the risk taken by our investors and provide proactive communication to our advisors/investors to help maintain strong relationships. Our philosophy is to create competitive investment portfolios that stand out in composition and returns with an emphasis on maintaining low costs so that our advisors can price their advisory fees to benefit their clients.

A Disciplined Approach

High-Frequency communication

- Weekly Meetings—The weekly meetings are used to keep abreast of market changes and keep on top of tactical trading opportunities.

- Monthly Meetings—The monthly meetings are used to review the performance of the models relative to benchmarks and get input from other committee members/vendors.

- Quarterly Meetings—The quarterly meetings include a live quarterly economic update from our partners. Each quarter, WCG’s asset allocation is measured against LPL, Morningstar, and other model allocations for reference.

Research and Oversight

The ISC utilizes industry and LPL research to screen portfolio holdings and potential holdings. Additionally, each quarter the ISC will have other institutional asset managers review and stress test the models for any recommended changes and ideas.

ESG Offering

Our High Impact Portfolios (HIP) invest in companies developing innovative solutions to global sustainability challenges, promoting gender diversity and women’s leadership, and supporting community-based financial institutions that promote small businesses, healthcare, education, and housing. By working with fund managers that are actively involved in shareholder advocacy and public policy engagement, these portfolios are created by screening the investment universe for opportunities seeking both financial returns and social good. WCG has emerged as a leader in ESG portfolio management and many of our advisors use this tool to help meet their clients desire to match their personal values with their investments.

Insurance Services

Illustration Support

Our insurance consultants can assist with your risk management needs by discussing your client’s financial plan and your recommendations.

Policy Analysis

Whether you do or don’t have a background in insurance, our team is equipped to help you analyze existing insurance contracts to make sure they are meeting your client’s needs.

Underwriting Advocacy

Illustrations, advanced concepts, and analysis are only the start; we support the entire process which includes seeing your case through to issue. Our underwriting advocacy helps to navigate the various medical and financial requirements to assist in getting the policy issued.

Advanced Concepts

In addition to our in-house team, we have access through our vendor-partners to teams of attorneys and other experts in concepts and case design.

Outsourced Insurance Services

We find that some advisors prefer not to be involved in the insurance process. To assist in helping your clients secure the protection they need (and as recommended in their financial plan) we have available “outsourced” insurance services for a pre-arranged split of the case.

Marketing and Practice Management

Driven by the WCG Marketing and Practice Management Committee and industry best practices, our support brings best practices together for your implementation. Additionally, WCG offers practice consulting, with a robust relationship management program for advisors.

Practice Management

As an independent (or newly independent) advisor, your business is your life. Let us help you build the best one possible. Practice Management is not just about improving the client experience, adding efficiency, managing risk, maximizing your human capital, and growing your business the way you want. It’s also about helping you to find your “why” to make your dreams and visions a reality. We strive to offer a combination of support options for advisors:

Workshops and webinars

- Attend our webinars and regional events where you'll work directly with our seasoned team members, network with peers, and get hands-on support.

- Advisor Resource Center (ARC) focused sessions to help you maximize your WCG relationship to create more time in your day.

- Partner-supported webinars and programs offering comprehensive and specialty topics

One-on-one guidance

- For select advisors, you’ll work with our in-house practice management consultant to build a custom plan to support the future vision of your business.

WCG Premier Events

- Collaborate Conference

- Our annual education conference featuring advisor panels and industry speakers with a variety of practice-building sessions.

- Roundtable Meetings

- Regionally hosted “study group” type meetings are held throughout the year with topics driven by advisor attendees to share best practices among WCG advisors.

- Monthly Webinars

- Monthly updates from WCG followed by advisor-led best practices discussions

- Quarterly Compliance Webinars

- Our compliance team presents and discusses relevant industry information and updates to make sure you know pertinent information to help you run a better business.

- Topical Webinars

- Hosted on an “as-needed” basis to share topical information and “what’s working out there” content.

Marketing

- Onboarding

- It’s important to have your marketing and branding materials ready when you transition, our Marketing Department works with you ahead of your transition date to prepare all necessary collateral.

- Co-branding

- Many advisors brand WCG, but many do not. Our materials are designed with branding and co-branding in mind for your DBA.

- Website

- Our WCG website is scaled for sharing with you for your DBA, or if you are in need of an individual site.

- Outsource Marketing

- For personal branding work, as well as unique marketing and branding needs we have an “on staff” marketing firm available for your needs on a consulting basis.

Compliance & Operations

- WCG helps ease your operational burden by assisting advisors in all areas of regulatory compliance. Our Chief Compliance Officer and Series 24 LPL Registered staff members will help ensure that your practice is compliant. Services include but are not limited to: trade blotter/email/correspondence review, annuity/alternative investment/new account review, best practices webinars, ADV maintenance and update, maintaining and monitoring of advisory licenses/books and records, audit preparation, OBA review and approval, compliance vulnerability and risk identification and evaluation of compliance issues/concerns. Compliance files are processed electronically and are uploaded to LPL on your behalf.

Onboarding & Transition

- Our experienced Operations team has transitioned over 90 advisors to date. Your assigned coordinator facilitates your onboarding to prepare for a smooth transition, followed by active monitoring as you begin to move your clients to WCG.

Additional Services:

Technology

At WCG, we stress the importance of utilizing current technologies to remain relevant and to increase efficiency. For this reason, we offer and encourage the use of ClientWorks, Orion, eMoney, Riskalyze, Redtail, Salesforce, and more. WCG and/or LPL have secured vendor affinity discounts for many of these programs. Our team is available to conduct in-house or remote technology support to ensure that advisor teams are getting the most out of these programs.

Compensation

The majority of advisory compensation is billed in advance. As such WCG processes advisor compensation monthly using a method of ‘smoothing’ to assist in cash flow for advisors. We also have a comprehensive compensation system with on-demand access and easy-to-interpret data.

Virtual Admin Program

Many advisors struggle to hire, replace or add administrative support for their practice. Through our Virtual Admin Program, advisors can contract part-time support for the completion of tasks involving, event planning, mailings, CRM clean-up, account opening, client service and scheduling, social media, special projects, and more.

HR Services

Advisors may outsource HR services to WCG. As a W-2 employee of WCG, your support staff members will be eligible for a benefits package to include group health.

Succession Planning

WCG understands the importance of a solid exit strategy to ensure the continued success of your practice and exceptional service to your clients. Our business continuity plan is designed with the goal to protect you and your family, as well as provide confidence to your clients.