ISC Model Update - January 2020

After a strong start to the year, stocks stumbled and finished the month in negative territory amid concerns over the outbreak of Coronavirus,

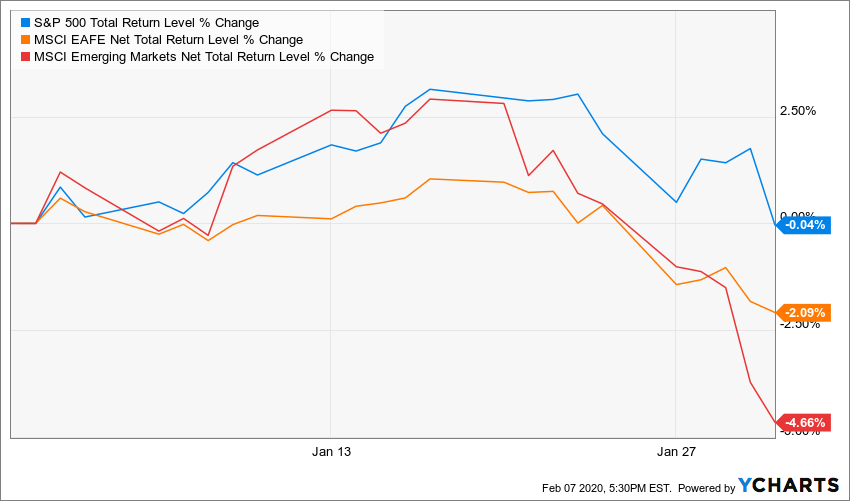

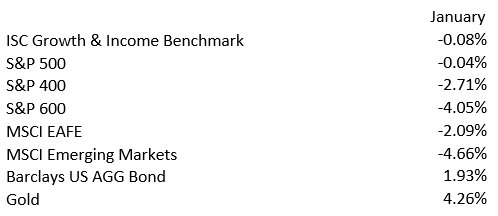

since classified COVID-19, and its economic impact. As was mentioned in last month’s commentary, the majority of last year’s gains were attributable to multiple expansion as the market looked through weakness and towards a reacceleration of growth this year. That did leave valuations stretched from a historical perspective coming into the year, and thus, markets were vulnerable to any disruption in the growth outlook. At the close of January, the response of the U.S. market was still muted relative to international.

Flash in the Pan

The market’s verdict on whether or not Q4 2019’s rotation out of U.S. large cap growth was a “flash in the pan” was rendered with resounding yes to start 2020. For now, it appears the U.S. is still the only game in town with the S&P 500 outperforming the MSCI EAFE and Emerging Market indices.

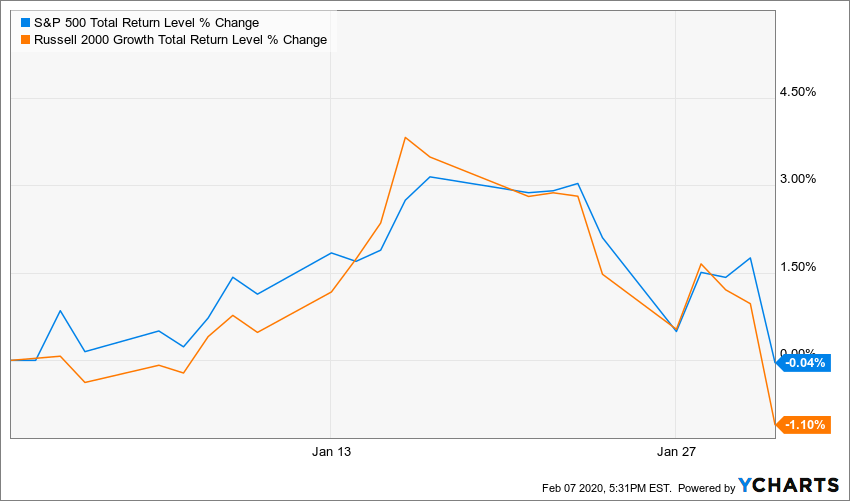

Small caps underperformed large.

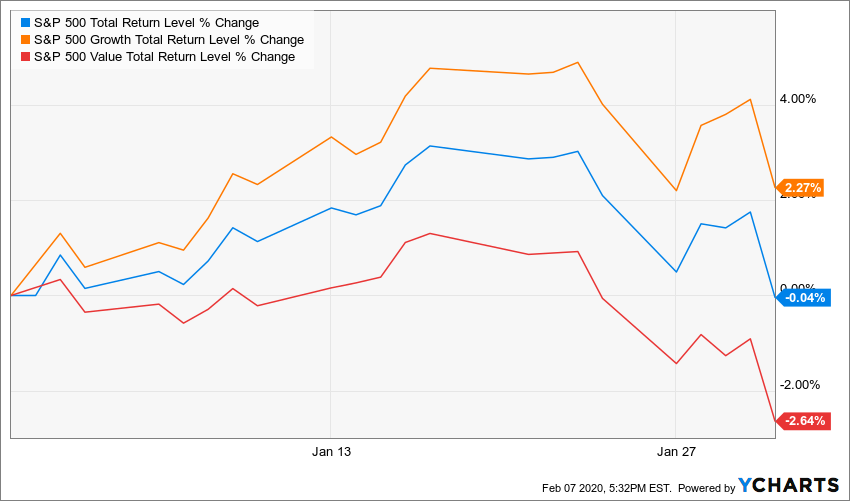

And growth handily outperformed value.

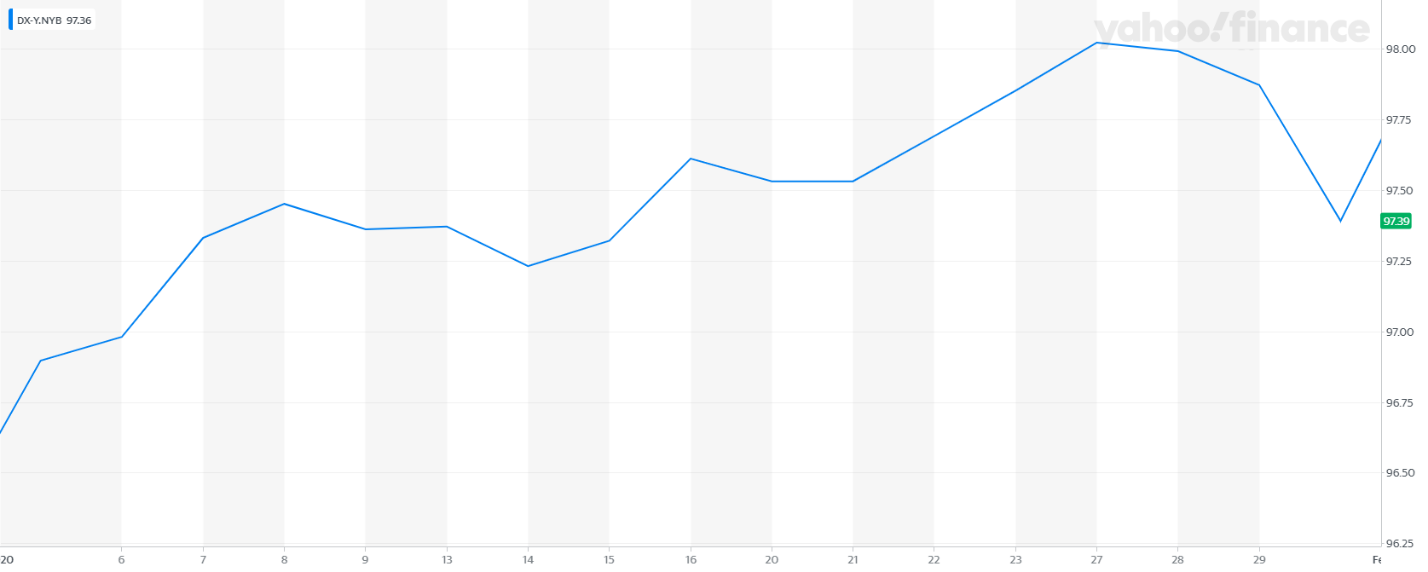

The strength of the dollar was posited as a potential factor, and on cue, the dollar rose in concert for the month of January as represented by the DXY index.

For now, it appears Q4 2019 was another false start for a secular shift out of growth.

Disclosures

- The ISC Growth & Income Benchmark is a blend of 33% S&P 500, 9.6% S&P 400, 2.4% S&P 600, 10.8% MSCI EAFE, 4.2% MSCI Emerging Markets, 37% Barclays Aggregate, and 3% Cash.

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

- The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

- The prices of small and mid-cap stocks are generally more volatile than large cap stocks.

- Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

- The fast price swings in commodities and currencies will result in significant volatility in an investor’s holdings.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Value investments can perform differently from the market as a whole. They can remain undervalued by the marker for long periods of times.

- WCG Wealth Advisors, The Wealth Consulting Group and LPL Financial are not affiliated with any of the entities referenced.

- The S&P 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through chanced in the aggregate market value of 500 stocks representing all major industries

- The S&P Growth and Value Indices are companies in each U.S. index that are split into two groups bases on price-to-book ratio to create growth and value indices. The Value index contains companies with lower price-to-book ratios, while the Growth index contains those with higher ratios.

- The S&P Midcap 400 Stock Index is an unmanaged index generally representative of the market for the stocks of mid-sized US companies.

- The S&P Small Cap 600 Index is an unmanaged index generally representative of the market for the stocks of small capitalization U.S. companies.

- The MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada.

- The MSCI EM (Emerging Markets) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the emerging market countries of the Americas, Europe, the Middle East, Africa and Asia.

- The Russell 2000 Index is an unmanaged index generally representative of the 2,000 smallest companies in the Russell 3000 index, which represents approximately 10% of the total market capitalization of the Russell 3000 Index.

- The Bloomberg Barclays U.S Aggregate Bond Index is and index of the U.S. investment-grade bond market, including both government and corporate bonds.

- The Dow Jones Industrial Average is comprised of 30 stocks that are major factors in their industries and widely help by individuals and institutional investors.

- The U.S. Dollar Index is an index of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners’ currencies.