The Power of Compounding and Disciplined Investing

Many years ago, I came across a client who was in her early thirties. She asked if I would review her investment portfolio.

Her portfolio consisted of just one equity mutual fund. It wasn’t a remarkable fund and, after looking at it more closely and comparing it to other funds, it looked like it been a below average performing fund for quite some time.

But looking at the statement closer and looking at the value of the portfolio, I became a little confused. She wasn’t that old. How in the world did she grow her portfolio this much. Surely, this must have been an inheritance or maybe she won the lottery and invested the proceeds.

As it turned out, she started investing in this fund when she was just 17 years old. Not only that, but she never wavered during market downturns, and she consistently put money into the fund every year.

What I learned that day more than 22 years ago was that it didn’t matter that the mutual fund was below average or that the advisor didn’t put her in the optimal asset allocation or that her fees and expenses weren’t the lowest. All these things might have helped, but these were not the material reasons why she had been so successful.

What did matter was that she:

- She started early

- She was disciplined

- She kept adding to the account consistently

Starting Early

There’s just no way to get around the benefit of starting early unless one already starts with a large amount of funds, and they perform much better over a shorter period of time. I have written on the power of compounding before and this wonder never ceases to amaze me.

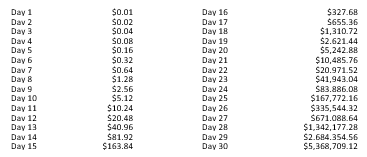

Here’s an interesting question, would you rather have $1 million today or would you rather have a penny today, but the value doubles every day for the next 30 days? We find the investor that chooses a penny today will have roughly $5.4 million by day 30 (see table below), more than five times the amount of taking the $1 million.

Let’s look at another example:

Barbara starts investing at 20 years old. She starts with just $5000. She earns 10% a year on average for 40 years. On just that small $5000 investment, her account grows to roughly $230,000.

Rita, on the other hand, starts investing at age 45 and starts with $50,000. She earns the same 10% and starts with ten times the amount as Barbara but makes less than Barbara because she has only 15 years of time in the market.

If we delay when we start investing until it is very late, we may have a harder time feeling calm during a market downturn because we might start needing the money much sooner.

An investor I know waited to start investing until his late 50s. He was hoping to make up for lost time. He had a very successful business but never saved for retirement. Not only did he have much less time to be in the market, but he couldn’t afford to take on as much risk because his retirement window to withdraw funds was fast approaching.

Starting early is one of the best things that parents can teach their children, not just about investing, but planning and budgeting as well.

Discipline

Perhaps one of the hardest things for investors to do is stay disciplined. We’re human. We have emotions. But working with the right advisor, sticking to a budget, and having a plan in place can make all the difference.

When we combine starting early with discipline, this can make the ride smoother because we are thinking more long term about our goals. Day to day market fluctuations or a bad market every so many years doesn’t deter us, as our vision is for decades, not month to month or even year to year.

Disciplined investors focus not on daily headlines or market fluctuations, but on one question – does this impact my long-term plan and goals? If the answer is no, they may avoid making emotional decisions when things feel bleakest.

Armed with discipline, investors can also think about some things differently. They can ask questions such as – Am I living within my means? Are there expenses that I can remove or reduce? Are their credit cards or a car loan that can be paid off quicker? Is my emergency savings what it should be? Am I donating to all of the causes that I wish to donate? Am I saving enough for retirement?

Discipline is also extremely worthwhile to teach our children.

Keep Adding

The questions above may lead investors to find some extra money that can be invested, either opportunistically or systematically. When we add to our investments, this can boost the compounding.

Investing opportunistically means investing when no one else wants to invest. Legendary investor Warren Buffett said we should be “fearful when others are greedy, and greedy when others are fearful.”

When a store sells items for 50% off the current price, we get excited. But when the stock market is down 20% or more, oddly people may be more apt to sell than to buy.

Investing systematically means we invest based on a timeline and do so regardless of market conditions. This is akin to dollar cost averaging. We could invest every month, every quarter, or every year. We invest the same amount when the market is high as when the market is low. By doing this, we systematically buy fewer shares when the market is high and more shares when the market is low.

When we combine the elements of starting early, staying disciplines, and regularly adding to our investments, we can harness the power of compounding, something Albert Einstein purportedly said was the “eighth wonder of the world.”

Jim Worden offers investment advice through WCG Wealth Advisors, LLC a Registered Investment Advisor doing business as The Wealth Consulting Group. Jim is not affiliated with LPL Financial.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

All performance referenced is historical and is no guarantee for future results. All indices are unmanaged and may not be invested into directly.