Weekly Commentary 09.11.2023

All the work, work, work.

2023 has been a remarkable year so far. It has, “confounded economists, humbled forecasters, and rewarded investors. Despite a rapid rise in interest rates, the U.S. economy continues to grow. Inflation has fallen – if not quite to desired levels – and stocks have entered a bull market, with the S&P 500 gaining 17% year to date and the Nasdaq Composite up more than 30%,” reported Nicholas Jasinski of Barron’s.

One of the biggest surprises has been the strength of the labor market. Over the 12-month period through August 31, 2023, employers added about 271,000 new jobs each month, on average, according to the U.S. Bureau of Labor Statistics. (In August, 187,000 new jobs were created, suggesting some labor market softening.)

So far this year, we’ve seen:

4-of-5 prime-age workers working. Last summer, the employment-to-population ratio, which compares the number of people employed to the civilian population of a city, state, or country, reached a 20-year high for 25- to 54-year-olds. In June, July and August, the ratio was 80.9 percent, according to the St. Louis Federal Reserve (SLFR).

“This ratio is a good barometer of the overall health of the labor market because it excludes younger people who are more likely to be in and out of school as well as older people who may be retired,” reported Stephanie Hughes of Marketplace.

The employment-to-population ratio for women hit a record high. In the second quarter, the employment-to-population ratio for women reached 75 percent – a new record. Three-of-4 women, ages 25 to 54, were employed, according to the SLFR.

“Women are crushing it in the labor market right now – their return to work from the pandemic has been faster than men’s…A big part of this is the rise of remote and flexible work, which has enabled a record number of women with young children to enter or remain in the workforce,” reported Emily Peck of Axios Markets.

The labor force participation rate increase. The labor force participation rate – the number of people who are employed or are seeking employment – remained stubbornly low even after the U.S. economy reopened following pandemic closures. In August, the labor force participation rate increased to the highest level since the pandemic.

“The labor market continues to rebalance in a healthy direction. The U.S. economy is still adding jobs…And, for employers, there are now more workers available per open positions, and wage pressures are abating,” reported Jasinski of Barron’s.

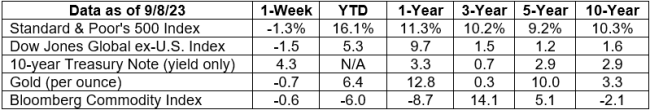

Last week, major U.S. stock indices moved lower when economic data raised concerns the Fed may need to raise rates again, according to Barron’s. In the Treasury market, the yield on the 30-year U.S. Treasury bond finished the week at 4.3 percent.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance; MarketWatch; djindexes.com; U.S. Treasury; London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

HEADWINDS FOR HOME BUYERS. If you’ve ever taken a long bike ride on a windy day, you know that cycling into a headwind can be difficult and discouraging. Riders spend more energy, travel more slowly, and may give up before reaching their goal. During much of 2023, prospective homebuyers have encountered strong market headwinds, including low inventory, high prices, lots of competition, and rising mortgage rates.

The United States has been experiencing a sellers’ market – where home sellers have an advantage over home buyers. In times like these, it can be difficult to remember that residential real estate tends to be cyclical. While buyers face headwinds today, the market is likely to shift in the future, giving buyers the advantage.

Determining where we are in the cycle has become more challenging because new factors are affecting the market. These include:

The popularity of remote work. “One thing that has surprised me is the permanence of work-from-home. If you look at how many people are going to the office, it has decreased significantly. Even for people who returned to the office, it’s not every day. So if you only have to be in the office a few days a week, you’re willing to have a longer commute. Demand for more space in certain areas of the country has increased, which has boosted house prices,” said Northwestern University Associate Professor Charles Nathanson in an interview with Kellogg Insight.

Concerns about climate risks. Eighty-three percent of prospective home buyers consider the risk of flood, hurricane, wildfire, extreme temperatures, and drought, according to a new survey. Climate risks are considered by 90 percent prospective homebuyers in the West, 85 percent in the Northeast, 79 percent in the South, and 77 percent in the Midwest.

Housing prices remained flat, year-over-year, in June 2023, according to the S&P CoreLogic Case-Shiller U.S. National Home Price Index. The 20-city index showed prices moving higher in 10 cities and lower in 10 cities.

Weekly Focus – Think About It

“The one thing all humans share is that we all inhabit the same limited amount of real estate, which is Planet Earth.”

—Bjarke Ingels,architect

Sources:

https://www.barrons.com/articles/stock-market-future-outlook-71604898?mod=hp_MAG (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/09-11-23_Barrons_Can%20the%20Stock%20Markets%20Rally%20Keep%20Going_1.pdf) https://www.bls.gov/ces/publications/highlights/2023/current-employment-statistics-highlights-08-2023.pdf https://www.investopedia.com/terms/e/employment_to_population_ratio.asphttps://fred.stlouisfed.org/series/LNS12300060 https://www.marketplace.org/2023/05/29/4-out-of-5-prime-age-workers-employed/ https://fred.stlouisfed.org/series/LREM25FEUSQ156S https://www.axios.com/2023/09/06/gender-gap-workplace-participation-statistics# https://www.barrons.com/articles/stock-market-jobs-report-inflation-fed-1a5a1a5b?mod=Searchresults (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/09-11-23_Barrons_August%20Jobs%20Report%20Shows%20Labor%20Markets%20Cooling_8.pdf) https://www.barrons.com/livecoverage/stock-market-today-090823?mod=article_inline (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/09-11-23_Barrons_Stock%20Market%20Today_9.pdf) https://www.barrons.com/market-data?mod=BOL_TOPNAV (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/09-11-23_Barrons_Data_10.pdf) https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202309 https://www.realtor.com/research/august-2023-data/#:~:text=The%20number%20of%20homes%20actively,9.2%25%20compared%20to%20last%20year https://insight.kellogg.northwestern.edu/article/understanding-pandemics-real-estate-effects https://zillow.mediaroom.com/2023-09-05-More-than-80-of-home-shoppers-consider-climate-risks-when-looking-for-a-new-home https://www.spglobal.com/spdji/en/index-announcements/article/sp-corelogic-case-shiller-index-positive-momentum-continues-in-june/ https://www.brainyquote.com/authors/bjarke-ingels-quotes