Weekly Market Commentary 03-16-2020

Weekly Market Commentary

March 16, 2020

The Markets

Last week was one for the history books.

Mid-week, the World Health Organization (WHO) declared coronavirus a global pandemic. At the time, there were more than 118,000 cases in 114 countries, and the death toll exceeded 4,000 people. On Friday, the Centers for Disease Control (CDC) reported 46 states and the District of Columbia have been affected, so far. As of Friday, there have been 1,629 confirmed and presumptive cases and 41 deaths.

As the need for containment became clear, daily life underwent rapid change. Major gatherings, from sporting events to Broadway shows to industry conferences, were canceled. Travel was restricted. Schools closed or moved to online classes. Restaurants and bars began serving fewer customers. Many Americans began working remotely or, in some cases, not working at all.

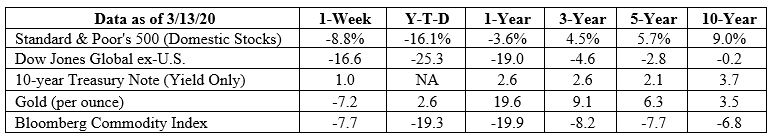

Uncertainty about the economic impact of the virus contributed to stock market volatility. Major American stock indices dropped into bear market territory, last week. Bear markets occur when prices drop by 20 percent or more from recent highs. Peter Wells of Financial Times reported:

“…a combination of fears stemming from the coronavirus pandemic, oil price plunge, and a global recession killed off an 11-year bull market. Wall Street’s equities benchmark plunged 9.5 percent on Thursday, its biggest one-day drop since Black Monday in October 1987 and also its fifth-biggest one-day drop since 1928.”

On Friday, President Trump declared the coronavirus a national emergency. Reshma Kapadia of Barron’s reported the declaration freed up $50 billion to support local, state, and federal efforts. It also “…grants new authorities to the Health and Human Services department, and gives doctors and hospitals greater flexibility to respond to the virus and care for patients…”

All three major U.S. stock indices rallied after the national emergency declaration, but it wasn’t enough to recover losses from earlier in the week. Chuck Mikolajczak of Reuters reported:

“The indexes were still about 20 percent below record highs hit in mid-February, and each saw declines of at least 8 percent for the week. Since hitting the highs, markets have been besieged with big swings in the market, nearly matching as many days with declines of at least 1 percent as all of 2019. Friday’s surge was the biggest one-day percentage gain for the S&P 500 since October 28, 2008.”

On Saturday, the House passed a bipartisan economic stimulus and relief bill to provide support while the coronavirus is being contained. It is expected to pass the Senate next week, reported

Erica Werner, Mike DeBonis, Paul Kane, and Jeff Stein of The Washington Post. The current legislation is separate from the $8.3 billion emergency spending bill passed two weeks ago.

The CBOE Volatility Index (VIX), which is known as Wall Street’s fear gauge, traded above 50 every day last week. At the start of the year, the VIX was trading at 12.47, and it has averaged 22.05 during 2020 to date, reported Macrotrends. A high VIX reading indicates traders anticipate markets will remain volatile.

Recent bouts of volatility appear to have been caused by institutional trading rather than individual investors. Abby Schultz of Penta reported:

“…individual investors are largely sitting tight, according to survey data from Spectrem Group in Chicago. About three-quarters of investors with $100,000 to $25 million in investable assets who were surveyed between Wednesday, March 4…and Monday, March 9…did not change their investment portfolios at all in light of the market sell-off…Among those with $5 million to $10 million in investable assets, as well as those with $10 million to $15 million, 31 percent bought stocks in the last 20 days…Among those with $15 million to $25 million, 39 percent bought stocks…”

Ready for a laugh?

One of the most important things any of us can do right now is to stay calm. Sometimes deep breathing can restore calm. Laughter can be soothing, too. The Mayo Clinic says laughter is a solid stress reliever. “A good laugh has great short-term effects. When you start to laugh, it doesn't just lighten your load mentally, it actually induces physical changes in your body.” As it turns out, laughing stimulates organs and soothes tension.

In the interest of promoting calm, we offer a few remarkable ways students have answered test questions. Bored Panda explained, “These bright pupils came up with the funniest test answers harnessing the powers of puns and their creativity.”

Test question: Briefly explain what hard water is.

Answer: Ice

Test question: What is the strongest force on Earth?

Answer: Love

Test question: Expand (a+b)n

Answer: = ( a + b )n

Test question: Choose the right word: The man [hit/fit] the dog.

Answer: Pet. You should not hit dogs.

Test question: Write an example of a risk.

Answer: This.

Test question: Fill in the blank: I earn money at home by _____.

Answer: I don’t. I am a freeloader.

During these stressful times, we hope you find some moments of humor and good cheer.

Weekly Focus – Think About It

“Prediction is very difficult, especially if it’s about the future.” --Niels Bohr, Danish physicist and Nobel laureate in Physics

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, and not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.cdc.gov/coronavirus/2019-ncov/cases-in-us.html#2019coronavirus-summary

https://www.investopedia.com/terms/b/bearmarket.asp

https://www.ft.com/content/d895a54c-64a4-11ea-a6cd-df28cc3c6a68

https://www.barrons.com/articles/coronavirus-playbook-heres-what-governments-need-to-do-51584128183

https://www.washingtonpost.com/us-policy/2020/03/13/paid-leave-democrats-trump-deal-coronavirus/

https://www.macrotrends.net/2603/vix-volatility-index-historical-chart

https://www.mayoclinic.org/healthy-lifestyle/stress-management/in-depth/stress-relief/art-20044456