Weekly Market Commentary 03.27.2023

The Markets

What’s your jam?

When you think of fun, are you running an Arctic marathon? Biking to your favorite burger place? Gaming with friends online? Each has inherent risk: Polar bears and hypothermia, traffic and flat tires, and viruses and identity theft. Those who enjoy these activities, understand the possible risks and manage them.

Investing is similar. Investors are willing to take on risk to achieve their long-term financial goals, but not everyone manages it in the same way. Some people are willing to embrace risk, and others prefer a less adventurous option. While it’s not possible to completely eliminate the risks associated with investing, it is possible to manage investment risk with asset allocation, diversification, and other strategies.

Last week, investors responded to the uncertainty created by bank closures in a variety of ways. Some sold assets they felt had too much risk for the current market environment, opting for sectors and industries that have historically shown resilience during economic slowdowns. Others snapped up investments at discounted prices, reported Ryan Ermey of CNBC. Some investors did nothing.

“The smartest thing to do when you have a lot of uncertainty is to sit back and gather information and do your analysis and not jump trying to make big changes,” stated a source cited by Lu Wang and Isabelle Lee of Bloomberg.

Uncertainty is likely to persist as economists and analysts assess how the American economy may be affected. “Banking panics aren’t something to be trifled with. As Fed Chairman Jerome Powell acknowledged on Wednesday, the latest one is sure to slow the economy…The problem, however, isn’t the possibility of more bank failures. It’s that banks are likely to curtail lending—lending they had already started to limit,” reported Ben Levisohn of Barron’s.

As bank lending tightens, economic growth in the United States will probably slow. When it becomes more difficult for households and businesses to get credit, consumer spending tends to fall. Since consumer spending is the primary driver of economic growth in the U.S., the economy is likely to be affected and we may enter a recession, reported Rich Miller of Bloomberg.

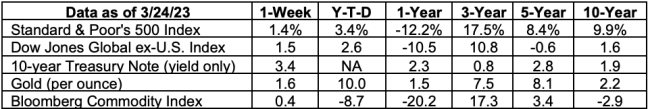

Major U.S. indices finished the week higher, while U.S. Treasury yields rose before retreating again.

If you are feeling unsettled by market volatility, get in touch. We can review your goals and allocations to make sure they’re aligned.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance; MarketWatch; djindexes.com; U.S. Treasury; London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

IS THERE A NO-VENTING ZONE?

When the dangers of secondhand smoke were confirmed, an early solution in many restaurants was the no-smoking section. Now, researchers report that emotions may be contagious. When an expressive friend, family member or stranger shows emotion, it can influence the mood of those around them.

In other words, exposure to positive emotions can invoke happiness and goodwill in others, while negative emotions may spread stress and anxiety.

“Over the past decade, we have learned how our brains are hardwired for emotional contagion. Emotions spread via a wireless network of mirror neurons, which are tiny parts of the brain that allow us to empathize with others and understand what they’re feeling…if someone in your visual field is anxious and highly expressive — either verbally or non-verbally — there’s a high likelihood you’ll experience those emotions as well, negatively impacting your brain’s performance,” wrote Shawn Achor and Michelle Gielan in the Harvard Business Review.

Here's an interesting sidenote: stress can spread by scent, too.

No matter how stress is triggered, there are actions you can take to keep from being overwhelmed by secondhand stress and anxiety. These include:

- Identifying three things you are grateful for,

- Writing a brief email praising someone else,

- Discussing or writing about a positive experience,

- Exercising for half an hour, or

- Meditating for a few minutes.

The research has important implications for the workplace and the home.

Weekly Focus – Think About It

“For every minute you are angry you lose sixty seconds of happiness.” —Ralph Waldo Emerson, Philosopher

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.finra.org/investors/investing/investing-basics/risk

https://www.cnbc.com/2023/03/23/why-analysts-say-banks-will-be-fine.html

https://www.bloomberg.com/news/articles/2023-03-24/freezing-in-shock-is-working-pretty-well-in-stressed-out-markets (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/03-27-23_Bloomberg_Bank%20Chaos%20Tests%20Traders%20Nerves_3.pdf)

https://www.barrons.com/articles/the-stock-market-keeps-gaining-the-risks-keep-building-cb466d1?mod=hp_columnists (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/03-27-23_Barrons_The%20Stock%20Market%20Keeps%20Gaining%20Risks%20Keep%20Building_4.pdf)

https://www.bloomberg.com/news/articles/2022-11-21/us-banks-tighten-lending-standards-raising-risk-of-recession#xj4y7vzkg (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/03-27-23_Bloomberg_US%20Banks%20Are%20Tightening%20Lending%20Standards_5.pdf)

https://www.barrons.com/articles/stock-market-dow-nasdaq-s-p-500-6143c6d0?refsec=the-trader&mod=topics_the-trader (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/03-27-23_Barrons_The%20Floor%20Could%20Still%20Fall%20Out%20of%20this%20Stock%20Market_6.pdf)

https://link.springer.com/article/10.1007/BF00987285

https://hbr.org/2015/09/make-yourself-immune-to-secondhand-stress

https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0077144