Weekly Market Commentary 04.11.2022

The Markets

The first quarter of 2022 was jam-packed with volatility-inducing events: rising inflation, war in Ukraine, rising interest rates, sanctions on Russia, and a new COVID-19 outbreak in China.

Here’s a brief review of what happened during:

Inflation continued to rise. At the start of the year, consumers and investors were primarily concerned about inflation. In February, the Personal Consumption Expenditures Price Index showed core inflation, which excludes volatile food and energy prices, was up 5.4 percent year-over-year. That’s well above the Federal Reserve (Fed)’s two percent target for inflation.

The Fed began to tighten monetary policy late in 2021 by curtailing its bond-buying program. Investors expected the Fed to continue fighting inflation in 2022 by raising the federal funds target rate. Raising rates makes borrowing more expensive, which causes consumer and business spending to slow, demand for goods and services to drop, and prices to move lower, reported Carmen Reinicke of CNBC.

Russia invaded Ukraine and sanctions followed. In late February, Russia shocked the world by invading Ukraine. The war has devastated the people and the economy of Ukraine. The Kyiv School of Economics estimated that physical damage inflicted on Ukraine’s roads, bridges, rails, ports, residences, factories, airports, hospitals, and schools from February 24 to April 1 exceeded $68 billion, reported The Economist. As the human and economic costs of the war filtered through markets:

- Energy prices surged around the world: Oil prices finished the quarter 33 percent higher – after declining 20 percent from their highest price during the quarter. One result was that energy and utility sectors delivered strong returns relative to other market sectors during the quarter, reported Lauren Solberg of Morningstar.

Higher energy prices exacerbated global inflation. For example, rising fuel prices lifted other prices, too. The cost of diesel fuel, which is primarily used for trucking and shipping, rose 63 percent in the United States during the first quarter. Higher transportation and delivery costs were reflected in the cost of other goods, including food, reported Brian Swint of Barron’s.

- Global food prices increased: Ukraine and Russia were key exporters of grains and cooking oils, as well as other products. Since February, when the war began, the price of wheat has increased by almost 20 percent, corn by 19 percent, barley by 27 percent, and vegetable oils by 23 percent, according to The Economist.

Central banks continued to tighten monetary policy. The war in Ukraine complicated the outlook for economic growth and inflation around the world. Despite uncertainty about growth, many central banks tightened monetary policy to bring inflation down.

In the U.S., the Fed raised the federal funds target rate by 0.25 percent in March. Fed officials expect to raise rates six more times in 2022 and begin reducing the Fed’s balance sheet, a process known as quantitative tightening, at its May meeting.

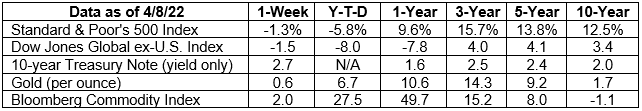

Yields on U.S. Treasury notes and bonds shifted higher during the quarter and into April. The yield on the 2-year Treasury note rose from 0.78 percent at the start of the year to 2.53 percent at the end of last week, while the benchmark 10-year Treasury yield rose from 1.63 percent to 2.72 percent. When bond yields rise, bond prices fall. In the first quarter, Morningstar indices for U.S. Treasuries, corporate, high-yield, and mortgage bonds all moved lower.

A new COVID-19 outbreak in China led to a lockdown in Shanghai. On March 28, Shanghai, China, a city of 25 million people, was locked down amid a new COVID-19 outbreak. A source cited by Reshma Kapadia of Barron’s stated:

“…concern is growing about the scars it may leave on Chinese consumers—a crucial growth engine for the struggling economy but also for a host of global companies…Consumers will be more cautious this time around. Their pandemic savings are depleting, wealth has been destroyed in equities and property and wage growth has already turned down.’”

The Shanghai Composite Index dropped by almost 10 percent during the quarter, reported Reuters.

Overall, stock markets declined during the first quarter of 2022. The MSCI All Country World Index (ACWI) measures the performance of mid-sized and large company stocks in 23 developed markets and 24 emerging markets. It reflects the performance of about 85 percent of the investable stocks across the world and finished the first quarter of 2022 -5.36 percent.

The were some regions that delivered positive returns during the period. For example, markets in some commodity-exporting countries in Latin America, Africa, and the Middle East benefitted from the supply disruptions that followed Russia’s invasion of Ukraine.

We anticipate that markets will remain volatile in the coming weeks and, possibly, months. We will continue to monitor events around the world and the ways in which they may affect markets and asset prices and we hope peace talks will conclude the war in Ukraine.

A CURE FOR ICE CREAM HEADACHES.

When the weather gets warmer, many people consume ice cream, slushies, and popsicles to cool down. Occasionally, that leads to brain freeze, reported Joseph Nordqvist in Medical News Today.

Brain freeze is the sharp, painful headache that occurs after you’ve eaten cold foods or drinks too quickly. When something extremely cold touches the roof of the mouth, the capillaries in the sinuses cool and blood vessels narrow. While many people press a palm to their foreheads when they experience brain freeze, that’s not a particularly effective cure. Better options may be to:

- Drink warm water,

- Press your tongue to the roof of your mouth to warm the area, or

- Cover your mouth and nose with your hands and breathe so warm air flows over your palate.

Here’s something else to keep in mind: eating hot foods on hot days may cool the body effectively, so long as the foods make you sweat. Sweating helps lower body temperature.

Weekly Focus – Think About It

“Strange as it may seem, I still hope for the best, even though the best, like an interesting piece of mail, so rarely arrives, and even when it does it can be lost so easily.”

—Lemony Snicket (Daniel Handler), author

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.bea.gov/news/2022/personal-income-and-outlays-february-2022

https://www.federalreserve.gov/faqs/economy_14400.htm

https://www.cnbc.com/2022/02/15/why-the-fed-raises-interest-rates-to-combat-inflation.html

https://www.economist.com/graphic-detail/2022/04/05/russias-war-in-ukraine-has-caused-at-least-68bn-in-physical-damage (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/04-11-22_Economist_Russias%20War%20in%20Ukraine%20Has%20Caused%20at%20least%2068Bn%20in%20Physical%20Damage_4.pdf)

https://www.morningstar.com/articles/1087132/13-charts-on-the-markets-first-quarter-performance (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/04-11-22_Morningstar_13%20Charts%20on%20the%20Markets%20First-Quarter%20Performance_5.pdf)

https://www.barrons.com/articles/crude-oil-prices-russia-sanctions-51649152164?refsec=oil (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/04-11-22_Barrons_Crude%20Oil%20Prices%20Rise%20on%20Threat%20of%20New%20Russia%20Sanctions_6.pdf)

https://www.economist.com/graphic-detail/2022/04/08/russias-invasion-of-ukraine-is-causing-record-high-food-prices (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/04-11-22_Economist_Russias%20Invasion%20of%20Ukraine%20is%20Causing%20Record-High%20Food%20Prices_7.pdf)

https://www.cfr.org/global/global-monetary-policy-tracker/p37726

https://www.federalreserve.gov/monetarypolicy/fomcprojtable20220316.htm

https://www.barrons.com/articles/shanghais-covid-lockdown-spells-trouble-for-chinese-consumers-thats-bad-news-for-global-companies-51649359398?mod=hp_columnists (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/04-11-22_Barrons_Shanghais%20Covid%20Lockdown%20Spells%20Trouble%20for%20Chinese%20Consumers_11.pdf)

https://www.msci.com/documents/10199/a71b65b5-d0ea-4b5c-a709-24b1213bc3c5

https://www.msci.com/end-of-day-data-search (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/04-11-22_MSCI_Emerging%20Markets%20Standard%20(Price)%20as%20of%20Mar%2031%202022_14.pdf)

https://www.medicalnewstoday.com/articles/244458#causes