Weekly Market Commentary 06.12.2023

The Markets

Leaping over the wall of worry.

The “wall of worry” is an obstacle – or set of obstacles – that investors face. This year, the wall reached a considerable height as inflation, the War in Ukraine, United States-China tensions, slower earnings growth, the high cost of residential real estate, low demand for commercial real estate, tightening credit conditions, and other issues weighed on investor confidence and consumer sentiment.

But the wall is not as tall as it once was.

- The banking crisis calmed.

- Debt-ceiling negotiations proved fruitful.

- The Federal Reserve may pause rate hikes.

Last week, investors leaped right over the wall, and the Standard & Poor’s 500 Index headed into a new bull market. Please note, there is no technical definition for a bull market. No regulatory body declares that a bull market has begun. The rule of thumb is this: when an investment or index rises 20 percent from its previous low, then it is in a bull market, reported Chuck Mikolajczak of Reuters.

There is a caveat to this bull market. The bull has not been charging across all sectors. The primary beneficiaries of investors’ enthusiasm have been information technology, communication services, and consumer discretionary stocks, reported Jacob Sonenshine of Barron’s. He wrote:

“It’s a badly kept secret that the S&P 500’s gains have been driven by shares of Big Tech companies...The seven biggest stocks gained 77% this year through the end of May, while the average stock in the index dropped 1.2%. That ‘bad breadth,’ as it’s known on Wall Street, has many investors waiting for the market to collapse when tech finally falters.”

There are a lot of investors sitting on the sidelines, waiting for the right moment to re-enter the market. Barron’s reported that Bank of America’s survey of asset managers found that the average asset manager has about 6 percent of their portfolio in cash right now, up from 4 percent at the end of 2021.

In contrast, bullish sentiment among participants in the AAII Investor Survey, which many view as a contrarian indicator, was way up last week, jumping from 29.1 percent to 44.5 percent. Bearish sentiment dropped from 36.8 percent to 24.3 percent.

Last week, major U.S. stock indices moved higher last week, reported Nicholas Jasinski of Barron’s. Yields on ultra-short U.S. Treasuries fell last week, while yields on longer maturities of Treasuries rose.

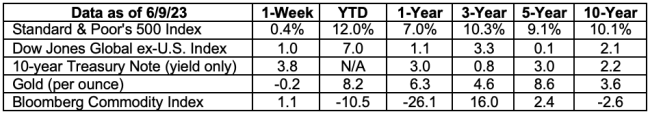

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance; MarketWatch; djindexes.com; U.S. Treasury; London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

FUTBOL AND THE COST OF LIVING.

There was big news for U.S. soccer last week. Argentinian star Lionel Messi announced he won’t be joining Cristiano Ronaldo in the Saudi football league. Instead, he’s headed to Miami FC – the last-place team in the MLS’s Eastern Conference, reported Jessica Golden of CNBC. Needless to say, ticket sales were way up and so were ticket prices. The stadium in Miami has just 18,000 seats.

Miami was also in the news last week because of its cost of living. SmartAsset studied how much a $100,000 salary would buy in 76 U.S. cities, after taxes, based on the cost of living in each city. Among the cities in the study, $100,000 goes the furthest in:

1. Memphis, Tennessee

2. El Paso, Texas

3. Oklahoma City, Oklahoma

4. Corpus Christi, Texas

5. Lubbock, Texas

The low cost of living and lack of state income tax elevated seven Texas cities into the top 10, reported Patrick Villanova of SmartAsset. Miami came in at #57. That still made it more economical than many larger and more expensive locales.

Miami is a bargain for the wealthy, reported Natasha Solo-Lyons of Bloomberg, citing another Smart Asset study. People with income of $250,000 who move from New York City to Miami would have 32 percent more to spend, thanks to lower taxes and a lower cost of living. People from San Francisco would gain 24 percent, but those from Chicago would have just one percent more, reported Jaclyn DeJohn of SmartAsset.

If you’re really looking for a bargain, the least expensive cities in the U.S. are Brownsville, Texas; Dayton, Ohio; Wichita Falls, Texas; South Bend, Indiana; and Toledo, Ohio, according to Niche.com.

Weekly Focus – Think About It

“There is only one kind of shock worse than the totally unexpected: the expected for which one has refused to prepare.”

—Mary Renault, author

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.bloomberg.com/opinion/articles/2023-06-08/economic-pessimists-are-running-out-of-worries (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/06-12-23_Bloomberg_Economic%20Pessimists%20Are%20Running%20Out%20of%20Worries_1.pdf)

https://www.axios.com/2023/05/03/regional-banking-crisis-pacwest-westernalliance

https://www.reuters.com/markets/us/behold-wall-streets-new-bull-market-maybe-2023-06-08/ (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/06-12-23_Reuters_Behold%20Wall%20Streets%20New%20Bull%20Market%20Maybe_4.pdf)

https://www.barrons.com/articles/stock-market-bull-up-down-outlook-a7abb320?mod=hp_HERO (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/06-12-23_Barrons_Dont%20Fear%20the%20Bull%20Market_5.pdf)

https://www.aaii.com/sentimentsurvey

https://www.cnbc.com/2023/06/09/lionel-messi-to-miami-boosting-major-league-soccer-ticket-sales.html

https://www.bloomberg.com/news/articles/2023-06-08/moving-to-miami-from-nyc-saves-high-earners-200-000-in-taxes (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/06-12-23_Bloomberg_Leaving%20New%20York%20for%20Miami%20Can%20Save_10.pdf)

https://smartasset.com/data-studies/dd-what-100000-is-worth-2023

https://smartasset.com/data-studies/wall-street-south-nyc-miami-2023

https://www.niche.com/places-to-live/search/cities-with-the-lowest-cost-of-living/