Weekly Market Commentary 10.30.2023

The Mark Twain Effect?

Historically, economic theory was based on the idea that financial decisions were grounded in rational thought. In recent years, behavioral economists have recognized that people don’t always behave rationally. In fact, research has found that investors like shortcuts that help simplify decision-making. While rules of thumb can be helpful, it’s important to use common sense. Some investment theories are a bit wacky, such as:

- The Aspirin Indicator: This theory holds that there is an inverse correlation between aspirin production and stock market performance. When aspirin production is down, markets are up (fewer headaches). When production is up, stocks are down (more headaches).

- The Hemline Index: The idea behind this theory is that market rises and falls in line with skirt lengths. When skirts are shorter, the market rises. When hemlines move lower, the stock market does, too.

- The October Effect: This theory is that stock returns will be lower in October than in other months of the year. While there have been some impressive October stock market declines, the data doesn’t support the theory. Some believe the October Effect derives from a book written by Mark Twain. In The Tragedy of Pudd’nhead Wilson, Pudd’nhead cautions, “October. This is one of the peculiarly dangerous months to speculate stocks in.”

This year, U.S. stocks moved lower in October. Last week, the Standard & Poor’s 500 and Nasdaq 500 Composite Indices both entered correction territory, reported Connor Smith of Barron’s. A correction occurs when an Index (or stock) drops 10 percent to 20 percent from its previous high. In general, corrections are normal adjustments as stocks trend higher. On occasion, a correction can mark the start of a bear market, reported the Corporate Finance Institute.

No one likes to see a negative return on an account statement. Sometimes, when markets have moved lower, investors are tempted to make portfolio changes to minimize losses. This is rarely a good idea. Timing the market is exceptionally difficult. Missing just a few days of returns can dramatically affect long-term performance. A better choice is to have a well-diversified portfolio that is invested according to your long-term financial goals and then make changes when your goals change, or you experience a life transition.

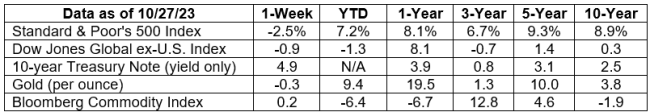

Last week, major U.S. stock indices moved lower, and yields on most longer-term U.S. Treasuries finished the week lower.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance; MarketWatch; djindexes.com; U.S. Treasury; London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

THINGS PEOPLE DON’T LIKE – AND THINGS THEY DO. Many people have strong opinions, especially when it comes to what they like and don’t like. Research has found that preferences are affected by our experiences, genetics, environment, family, friends and other factors, reported Ana Clemente in The Conversation. Some people, for example, have neophobia, an aversion to anything new or unfamiliar. Here are a few things that people have said they dislike, gathered from surveys and social media.

- Driving at night or in bad weather.

- Redoing a home repair because it was done poorly the first time.

- Making multiple trips to the hardware store for the same project.

- Working from 9 to 5 (commenters preferred a flexible schedule).

- Waiting in line.

- Rising prices, aka inflation.

- Oversharing on social media.

- Taking surveys.

- Worrying about income after retirement.

Sometimes, an unexpected event can spark delight and change your outlook. A snack company in the United Kingdom asked people the kinds of spontaneous surprises that improve their mood during the day or week. Here are some of the moments survey respondents enjoyed.

- Finding forgotten cash in the pocket of a jacket.

- Receiving a compliment from a stranger.

- Having someone let them go first at a store checkout.

- Hearing a favorite song on the radio.

- Being recognized with a bonus at work.

- Hitting all green lights as they drive along the road.

- Getting a whiff of a favorite scent from childhood.

- Having a loved one say they’re proud of you.

- Doing something nice for someone else.

Many respondents said spur-of-the-moment events brought joy, or restored their faith in humanity, about twice a week on average, reported The Good News Network.

What brings delight to your life?

Weekly Focus – Think About It

"But we overlay the present onto the past. We look back through the lens of what we know now, so we’re not seeing it as the people we were, we’re seeing it as the people we are, and that means the past has been radically altered.”

—Ann Patchett, author (Dutch House)

Best regards,

The Wealth Consulting Group

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate, and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stocks of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.mdpi.com/2227-9091/11/4/72

https://www.investopedia.com/articles/stocks/08/market-anomaly-efficient-market.asp

https://www.investopedia.com/terms/o/octobereffect.asp

https://en.wikipedia.org/wiki/Mark_Twain_effect#

https://gutenberg.org/cache/epub/102/pg102-images.html

https://www.barrons.com/livecoverage/stock-market-today-102723?mod=article_inline (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/10-30-23_Barrons_S&P%20500%20Joins%20Nasdaq%20in%20Correction%20Territory_6.pdf)

https://www.investopedia.com/articles/trading/07/market_timing.asp

https://www.barrons.com/market-data?mod=BOL_TOPNAV (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/10-30-23_Barrons%20Data_9.pdf)

https://www.smithsonianmag.com/science-nature/why-you-like-what-you-like-73470150/

https://www.buzzfeed.com/elizabeth_cotton/things-adults-hate-grown-up?origin=web-hf

https://www.pewresearch.org/short-reads/2014/02/03/what-people-like-dislike-about-facebook/

https://www.linkedin.com/pulse/better-survey-experience-what-people-dislike-surveys-andrew-grenville

https://www.goodnewsnetwork.org/top-30-most-delightful-things-that-happen-unexpectedly/

https://www.goodreads.com/author/quotes/7136914.Ann_Patchett