Weekly Market Commentary 11-30-2020

Weekly Market Commentary

November 23, 2020

The Markets

The U.S. economy is like a semi-trailer truck. No one likes being stuck behind a semi at a stoplight because big trucks don’t go from zero to 60 in 2.5 seconds. Neither does the U.S. economy.

When the pandemic brought our economy to a near virtual standstill early in 2020, the U.S. government and Federal Reserve (Fed) took extraordinary measures to help the economy get going again:

- Congress passed the CARES Act stimulus, which gave Americans and American businesses badly-needed fuel to support economic recovery. Businesses were able to stay open and people had money to spend. That’s important because consumer spending accounts for almost 70 percent of U.S. economic growth.

- The Federal Reserve paved the road and gave it a downward slope by creating a supportive interest rate environment and implementing special lending facilities intended to support businesses, as well as state and local governments. Some programs were funded by the CARES Act.

Government and central bank stimulus helped the American economy get going again.

Is slower growth ahead?

In recent weeks, however, there have been signs economic recovery may be losing momentum and the virus may, once again, be responsible.

Recently, the United States passed a grim milestone. The number of deaths attributed to COVID-19 surpassed 250,000. For perspective, that’s roughly equivalent to the population of Winston-Salem, North Carolina; Irving, Texas; or Buffalo, New York.

Last week, some economic data came in weaker than expected and initial unemployment claims ticked higher. Lucia Mutikani of Reuters reported:

“U.S. retail sales increased less than expected in October and could slow further, restrained by spiraling new COVID-19 infections and declining household income as millions of unemployed Americans lose government financial support…‘Fed officials are saying they might have to do more and today’s data may turn that thinking into a reality.’”

The Treasury curbs the Fed

The tools available to the Fed changed last week. The U.S. Treasury announced it will let several of the Fed’s Treasury-funded special lending programs expire at the end of 2020. Alexandra Scaggs of Barron’s reported the programs include:

- The Main Street Lending Program for small-to-mid-size businesses and non-profits

- The Municipal Liquidity Facility that lends directly to state and local governments

- Corporate Credit Facilities that purchase corporate bonds

For these programs to reopen in the future, Congress will need to appropriate new funds. One economist cited by CNBC said, “U.S. Treasury Secretary Steven Mnuchin’s decision to allow key pandemic relief programs to expire is like stripping the lifeboats from the Titanic.”

Not everyone agreed. “Programs like the municipal bond program and the Main Street Lending Program have not worked, in part because the Fed is a central bank. And when you demand that it take on fiscal government tasks…it does that very carefully, and, frankly, very badly,” explained an analyst interviewed on Marketplace Morning Report.

Despite changing monetary support, U.S. stock markets remained resilient. Ben Levisohn of Barron’s attributed the stock market’s resilience to positive vaccine news, which “…might not have pushed the stock market higher, but it sure was a reason not to sell.” Major indices finished the week slightly lower.

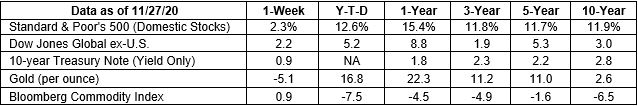

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, MarketWatch, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

And they’re off!

Holiday shoppers may not have been racing into brick-and-mortar retail stores, but that doesn’t mean they weren’t shopping. Consumers have earmarked about $998 for spending on winter holidays, which include Christmas, Hanukkah, and Kwanzaa, according to the National Retail Federation. They plan to spend:

- Slightly less on gifts for family, friends, and coworkers than they did last year

- Slightly more on food and decorations

- Significantly less on non-gift spending (buying that special something for yourself because the price is so attractive)

A lot of that money will be spent online. On Black Friday, U.S. consumers shelled out more than $9 billion online, reported TechCrunch. It was the second biggest day for digital commerce in history. The first was Cyber Monday 2019.

Overall, online holiday sales are expected to break all previous growth records. A report from Adobe estimated 2020 digital sales will be up 20 to 47 percent, year-over-year. That’s a broad range because there is a lot of uncertainty about levels of disposable income and capacity limits for brick-and-mortar stores. The report stated:

“If flu season brings with it a spike in [coronavirus] cases and an increase in store restrictions, a reduced store capacity will drive more people online. E-commerce is still only around one out of every $4 spent on retail. That’s a large bucket of dollars that could move online, leading to potential for big swings this season.”

Whether you are holiday shopping in person or online, or using a smartphone or computer, watching trends may help investors identify new investment opportunities.

Weekly Focus – Think About It

“As we struggle with shopping lists and invitations, compounded by December’s bad weather, it is good to be reminded that there are people in our lives who are worth this aggravation, and people to whom we are worth the same.”

--Donald E. Westlake, Crime fiction writer

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, and not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://press.princeton.edu/books/hardcover/9780691182292/narrative-economics

https://www.economist.com/united-states/2020/11/28/the-midwest-is-americas-covid-19-hotspot (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/11-30-20_TheEconomist-The_Midwest_is_Americas_COVID-19_Hotspot-Footnote_2.pdf)

https://www.washingtonpost.com/politics/2020/11/25/power-up-millions-face-benefits-evictions-cliff-congress-remains-stalled-relief-talks/ (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/11-30-20_TheWashingtonPost-Power_Up-Millions_Face_Benefits_and_Evictions_Cliff_as_Congress_Remains_Stalled_on_Relief_Talks-Footnote_4.pdf)

https://www.ft.com/content/1f4568ca-d6db-4e1c-be46-07bffcb87d80 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/11-30-20_FinancialTimes-Vaccines_Not_Politics_are_Driving_the_Soaring_Markets-Footnote_6.pdf)

https://www.ft.com/content/530e3c1c-306d-42e1-9f8c-33a2dc7af82a (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/11-30-20_FinancialTimes-Global_Stocks_Close_In_on_Best_Ever_Month-Footnote_7.pdf)

https://www.barrons.com/articles/why-the-stock-market-keeps-risingand-why-its-next-test-comes-next-week-51606515605?refsec=the-trader (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/11-30-20_Barrons-Why_the_Stock_Market_Keeps_Rising_and_Why_Its_Next_Test_Comes_Next_Week-Footnote_8.pdf)

https://nrf.com/insights/holiday-and-seasonal-trends/winter-holidays (Slides)

https://techcrunch.com/2020/11/28/black-friday-online-sales-numbers/

https://www.adobe.com/content/dam/www/us/en/adi/2020/pdfs/Adobe_Holiday_Predictions_2020.pdf (Page 6) (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/11-30-20_Adobe-Unboxing_2020s_Holiday_Shopping_Forecast-Footnote_11.pdf)